Building a Diversified Trading Portfolio: A Beginner’s Guide

Introduction

In trading, diversification is a crucial strategy for managing risk and enhancing potential returns. For beginners, building a diversified trading portfolio can seem daunting, but it's a key step towards achieving long-term success in the financial markets. This blog post will guide you through the basics of creating a diversified trading portfolio and how it can benefit your trading journey.

1. Understanding Diversification

What is Diversification?

Diversification involves spreading your investments across different assets or asset classes to reduce risk. By not putting all your eggs in one basket, you can minimize the impact of a poor-performing asset on your overall portfolio. The goal is to balance potential risks and rewards by investing in a variety of instruments that don’t move in perfect correlation with each other.

Why Diversify?

Diversification helps mitigate risk because different assets respond differently to market conditions. For example, while stocks might be volatile, bonds might provide stability. By holding a mix of asset classes, you can potentially reduce the volatility of your portfolio and improve your chances of achieving consistent returns.

2. Building a Diversified Trading Portfolio

Start with Asset Allocation

The first step in diversification is determining your asset allocation. This involves deciding how much of your portfolio to invest in different asset classes, such as stocks, bonds, commodities, and forex. Your allocation should reflect your risk tolerance, investment goals, and time horizon.

Consider Different Asset Classes

Explore Different Trading Strategies

Long-Term vs. Short-Term

Incorporate both long-term and short-term trading strategies to balance your portfolio. Long-term investments can provide growth over time, while short-term trades can capitalize on market fluctuations. This blend of strategies can help manage risk and capture various market opportunities.

Active vs. Passive

Active trading involves making frequent trades based on market conditions, while passive trading focuses on holding assets for longer periods. Including a mix of active and passive approaches can enhance your portfolio’s diversification and potentially improve returns.

3. Risk Management Techniques

Set Stop-Loss Orders

To protect your investments, use stop-loss orders to automatically sell an asset when it reaches a certain price. This helps limit potential losses and manage risk more effectively.

Diversify Within Asset Classes

Don’t just diversify across different asset classes—diversify within each asset class as well. For example, if you’re investing in stocks, consider different sectors and geographic regions. This approach further reduces risk and enhances potential returns.

4. Regular Review and Rebalancing

Monitor Your Portfolio

Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance. Keep an eye on performance, market conditions, and any changes in your personal circumstances that might require adjustments.

Rebalance as Needed

Rebalancing involves adjusting your asset allocation to maintain your desired level of diversification. Over time, some assets may grow faster than others, leading to an imbalance. Periodically rebalancing your portfolio helps maintain your risk tolerance and investment strategy.

Conclusion

Building a diversified trading portfolio is essential for managing risk and enhancing potential returns, especially for beginners. By understanding the basics of diversification, selecting a mix of asset classes and strategies, and implementing risk management techniques, you can create a balanced portfolio that supports your trading goals.

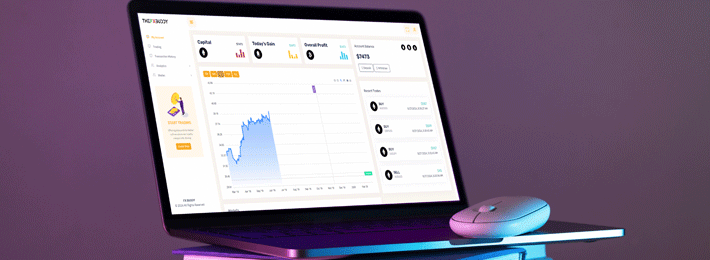

If you’re ready to start building your diversified trading portfolio, TheFXBuddy is here to help. Our platform offers the tools and resources you need to manage and optimize your investments effectively.

Call to Action

Ready to create a diversified trading portfolio? Sign up with TheFXBuddy today and get access to expert resources and tools to support your trading journey.